What Is Digital Signature Signing?

Digital signature signing represents a secure, legally binding method of electronically authenticating documents and verifying signer identity through advanced cryptographic technology. Unlike basic e-signatures, digital signatures utilize Public Key Infrastructure (PKI) to create a unique, tamper-proof fingerprint for each document, ensuring maximum security and compliance with global standards like eIDAS, UETA, and the ESIGN Act.

As an authorized Capricorn partner, we deliver enterprise-grade digital signature solutions that combine cutting-edge security with seamless integration into your existing workflows. Businesses leveraging our solution benefit from 90% faster document processing, 100% auditability, and zero paper-based overhead, while mitigating risks associated with forgery or tampering. Whether for contracts, financial agreements, or regulatory filings, our Capricorn validated technology ensures your digital transactions remain secure, legally enforceable, and globally recognized.

Common Use Cases of Digital Signing

Business Contracts

Obtain secure signatures on NDAs, vendor agreements, and partnership agreements using legally accepted digital signatures that provide verification and resistance to modification.

Financial Documents

Sign invoices, loan agreements, and tax submissions digitally to increase the speed of approvals while ensuring compliance with financial regulations.

Healthcare Records

Safeguard patient information privacy by digitally signing medical consent forms, e-prescriptions, and insurance claims with an authentication method that complies with HIPAA regulations.

Software Distribution

Sign software updates and applications to protect code integrity; therefore, verify publisher authenticity and protect against malware during distribution.

Government filings

File digital signatures that are legally recognised on things such as permits, tax filings, and official applications while securely expediting US bureaucratic processes.

HR & Employee Documents

Speed onboarding and save time digitally signing employee forms such as contracts, policy acknowledgements, and payroll documents while being audit-ready.

How Does Digital Signature Signing Work?

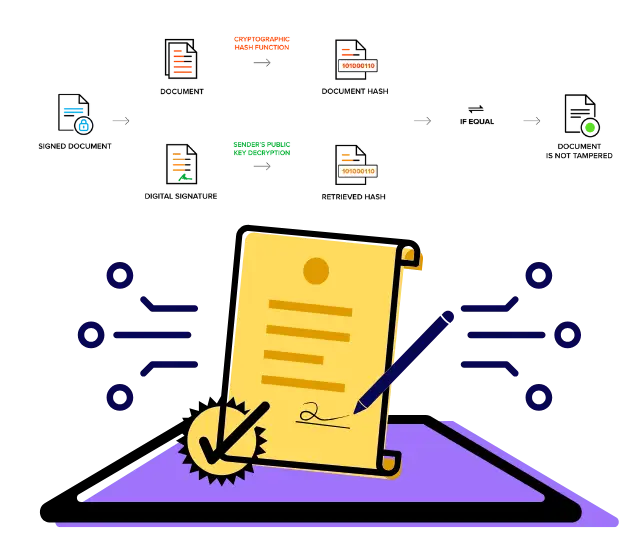

A digital signature Signing uses cryptographic technology to securely authenticate electronic documents. When a document is signed, a unique hash (digital fingerprint) is created and encrypted using the signer’s private key, forming the signature. The recipient verifies it by decrypting the signature with the signer’s public key and comparing the hashes—if they match, the document is untampered and legally binding. This process ensures authentication (proof of identity), integrity (no changes after signing), and non-repudiation (the signer cannot deny signing).

As a Capricorn partner, we enhance security with bank-grade encryption, blockchain timestamps, and compliance with global e-signature laws for foolproof transactions.

Why go with Vishwnet Digital signature signing?

Secure Authentication

Digital signature signing ensures the authenticity of the signer by using a unique private key, which confirms the identity of the person signing the document and verifies that the document has not been altered.

Integrity Assurance

Any changes made to the signed document after it has been digitally signed will invalidate the signature, ensuring that the content remains intact and unmodified, providing full integrity.

Legal Validity

A digital signature holds the same legal weight as a handwritten signature in many countries, making it legally binding and admissible in court, which streamlines online transactions and official agreements.